Starting on Jan. 1, 2026, the local minimum wage in unincorporated Boulder County is $16.82/hour.

See the full Boulder County Local Minimum Wage Ordinance (amended November 2025) for additional information.

Check if the Wage Applies to You or Your Business

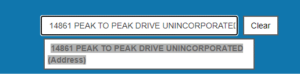

To find out if the local minimum wage applies to you as an employee or employer, enter the business address into the Boulder County property search tool.

If the result notes that the address is ‘UNINCORPORATED’ then the local minimum wage applies. It is important to check the property search tool because a mailing address with ‘Boulder’ or ‘Longmont’ may be located in unincorporated Boulder County.

Example

Unincorporated communities include Allenspark, Coal Creek Canyon, Eldora, Eldorado Springs, Gold Hill, parts of Gunbarrel, Hygiene, and Niwot.

For businesses not based in unincorporated Boulder County, the local minimum wage applies to any employees performing, or expected to perform, four or more hours of work in unincorporated Boulder County in any given week. See Frequently Asked Questions below for more information.

If you cannot find the address using the property search tool, contact the Commissioners’ Office by email commissioners@bouldercounty.gov or phone 303-441-3500.

Incorporated Towns and Cities

The local minimum wage does not apply to any incorporated areas of the county, including: Boulder, Erie, Jamestown, Lafayette, Longmont, Louisville, Lyons, Nederland, Superior, and Ward. The state minimum wage applies in these areas.