What Is Time Trending and How Is It Used?

2023/2024 Comparable Sales

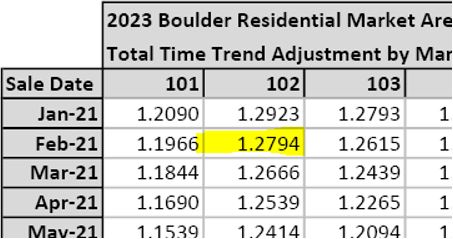

Time Trend Adjustments

By Colorado law, residential properties must be valued solely by the market approach using verified sales of similar homes. The study period of July 1, 2020 to June 30, 2022 was used to determine values for the 2023 reappraisal. The law also requires that all sales prices within the study period are time adjusted to reflect the actual market conditions on the June 30, 2022 appraisal date.

Calculating the Time Trend Adjusted Sales Price

Look up the Time Trend Adjustment for the specific Market Area and property type, month and year in which the property was sold using the 2023 Residential Time Trend information. Use this formula to calculate the adjusted price: original sales price X time trend adjustment = adjusted sales price.

Sales

Price X Time

Trend

Adjustment = Adjusted

Sales

Price

Example

Take a home sold in Market Area 102 in February of 2021 for $600,000. The files show the Time Trend Adjustment factor is 1.2794.

Using the formula above:

The adjusted sales price is $767,640.